Influx of Foreign Companies Sabotages Businesses from Finding an Office in Dublin

Dublin is currently experiencing a severe deficit in housing properties and office space. The Irish capital is rapidly becoming the next European tech hub. Google and Facebook’s bases alone has resulted in thousands of square feet of property to be diverted for their local tech camps. Reports show a number of start-ups are entering the market as well. Although 1.4 million sq. feet of new office space is under construction almost half of it has been already pre-let.

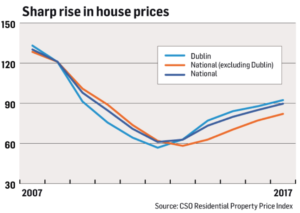

The pressure for office space also affects the housing market. While companies and start-ups find it difficult to establish an office in the Irish capital, real estate buyers are prevented from investing in houses due to the considerable shortage of available properties and the significant price increase in prices. Although home building underwent an uplift, the local market is not being able to alleviate the supply shortage.

The Irish real estate boom brings the question why more houses are not being built when there is a strong market demand?

After the inflation back in 2015 and Central Bank’s new rules on lending, property buyers became less enthusiastic in buying real estate. The driving demand for rental properties in the capital is the main reason why house prices are jumping. Experts believe this is part of a global trend that forces banks to play both sides, keeping the interest rates low, but still curtailing credit to prevent asset price boom.

While institutional investors keep buying properties and holding them for renting purposes, there is no supply at the lower end of the market. Currently, construction builders are not offering what people can afford.

Fast Cash Recovery

What attracts both institutional and individual investors to the Irish property market is the buy-to-let trend that keeps the prices high. Property owners keep seeking a cash recovery after the initial investment has being made. The current scene of banks offering deposits in return of higher charges makes real estate investments an enticing way to keep their resources secured.

The Vacancy Rate for Grade A Office in Dublin Has Declined

The vacancy rate for grade A offices in Dublin has declined. While there is some construction development undergoing, the availability is still critically low. With nearly half of the space being pre-let already, the supply remains confined. Bulk buyers are prone to keep invading the market with aggressive purchases, while it gets to the point where the profitability of the initial investment will bring the yields down. Research shows the housing market is no different than the office space one. Multiple units under construction are being sold in a single day to the same investor, making it impossible for buyers at the lower end to make a sole purchase.

Shorter Property Ladder

While investors who bulk-purchase properties in Ireland are inclined to keep investing, the younger generation are finding it more difficult to get on the property ladder. It is estimated millennial will own 1.7 homes on average, in comparison to their parents, who will own twice as many.